We usually trade cryptocurrencies in 3 ways. Number one is the long-term investment, which we also call an investment portfolio. Then, we keep some coins for short-term trading, which we sell after a week or two to profit. And number three is Intraday trading or daily trading.

We invest a lot of money, especially in holding long-term coins. Sometimes we lose by holding coins for a long time. Because maybe we don't know the proper system of holding or how to hold crypto for the long term, or which currency to hold.

*[Source](https://kriptomat.io/cryptocurrency/investing/)*

*[Source](https://kriptomat.io/cryptocurrency/investing/)*

Everyone says HODL, but no one says how to take care of this long-term investment. In today's article, I will share some of my thoughts on this subject.

Many people have been holding such coins for a long time, but the coins' price may be less than the price you bought. You are not seeing the face of profit for a very long time. Then you think - I'm showing the holding power, but why not making a profit!

Long-term investments can range from 3 months to 2-3 years. Usually, by investing in cryptocurrency for six months, we can expect a good return.

Now the question is how to select coins for long-term investment.

Many people in the neighborhood will say that - this coin will give a good profit, or if you hold that coin, you will get a lot of money. But no one will say why you can make a profit by holding a particular coin. No one (except a few) shows any analysis. We invest as soon as we hear from people. We don't even know why! Just like everyone else is doing, so am I!!!

Before investing money in any coin, decide for how long you are going to invest. How do I decide? First, check the Whitepaper and Roadmap of the coin you will invest in. You will get some important dates from the roadmap. If I buy a currency today with a big event coming up in December, I set a target to hold this coin until December. I will sell it as soon as the price goes up in December. So before making a long-term investment in a cryptocurrency, you have to study the roadmap of that currency well.

If you can't make a profit by holding a coin long term, you will get frustrated. And frustration comes when you have invested by watching everyone without learning the proper way to trade. You have no idea if the market will go up or down. Whether the market goes up 60 points or down 30 points, you have to profit from it.

You never know when your investment will double, or at least make a profit. You never know how long you will have to hold on. In this case, I follow an investment rule.

Suppose you will invest $1000. It could be any coin, it could be Ethereum, or it could be Hive; I'm talking about all the coins overall.

80% of the investment you will keep for the long term. Hold for a long time! 20% you will invest short period in the same coin. And whenever there is some profit (it can be 1% or 20%), you will sell. Collect profit straight away. Don't forget to use Stop loss while performing short-term trading.

And keep the remaining 20% for day trading or news trading. Many times a lot of news comes in certain currencies. Suppose you may have heard that Hive Coin will be listed on Poloniex tomorrow. In that case, you will immediately invest 20% of your capital in Hive. Because being listed on the exchange means that the price of the currency is likely to rise.

I am asking you to make your entire investment in the same coin at a 60-20-20 ratio. Because you'll see many people are holding and trading 10-12 types of crypto simultaneously, this is not a bad thing. But you can't analyze 10-12 types of coins at the same time. And you can't figure out which currency to sell at any given time. So it is better to concentrate on one coin. Then a foolproof idea about that market will be born.

As I said initially, trading is not so important; it is even more important to learn the trade. You have to know why you're making a loss; when a bull runs in the market. Once you understand why the failure is happening, you can make a profit.

That's all I can say about investment. But in which cryptocurrency will you make a long-term investment? There are many factors you need to consider here.

We look at the price at the beginning before selecting any coin, which I think is wrong. In the beginning, you have to look at the supply and market cap of currencies; the price depends on them.

One of the things we have in common is that we think the price of a cheap coin will go up, and we are interested in investing in a low-value coin. When a $1000 coin is added to the market, we think it might not go even to $1500. This is not always true.

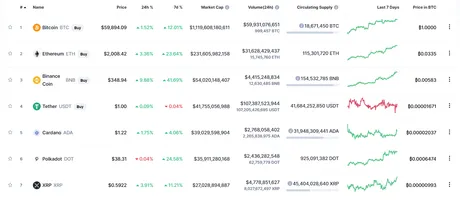

Everything depends on the market cap of the coin and the supply of that coin. I wouldn't say do complex fundamental analysis; mastering a new technology may not be easy for everyone. To get an idea about this, you can do basic research of the top 100 cryptocurrencies from Coinmarketcap.

You will see the volume of how many coins have been generated in 24 hours. Every new coin will generate a good volume if it is a good coin. That means buyers and sellers trade a lot on those coins, the buyer wants to buy, and the seller wants to sell. In that case, a lot of volumes will be generated. Suppose you may decide that if a new coin's volume exceeds 4000+ bitcoins or equivalent dollars in 24 hours, you will make a long-term investment in that coin.

Then you have to look at the chart of that coin. For example, you can consider coin selection by using the Moving average strategy in the 1-day chart.

I hope I have come up with some ideas on long-term investment in this article. Note that you have to follow what I have said. This is not a financial suggestion. I just shared how I make long-term investments.

You may share your ideas and strategies in the comment section.

Return from Long-Term Investment in Cryptocurrency - Factors You Should Consider to pitboy's Web3 Blog